Edinburgh Office Market 2025 Review

2025 Market Overview

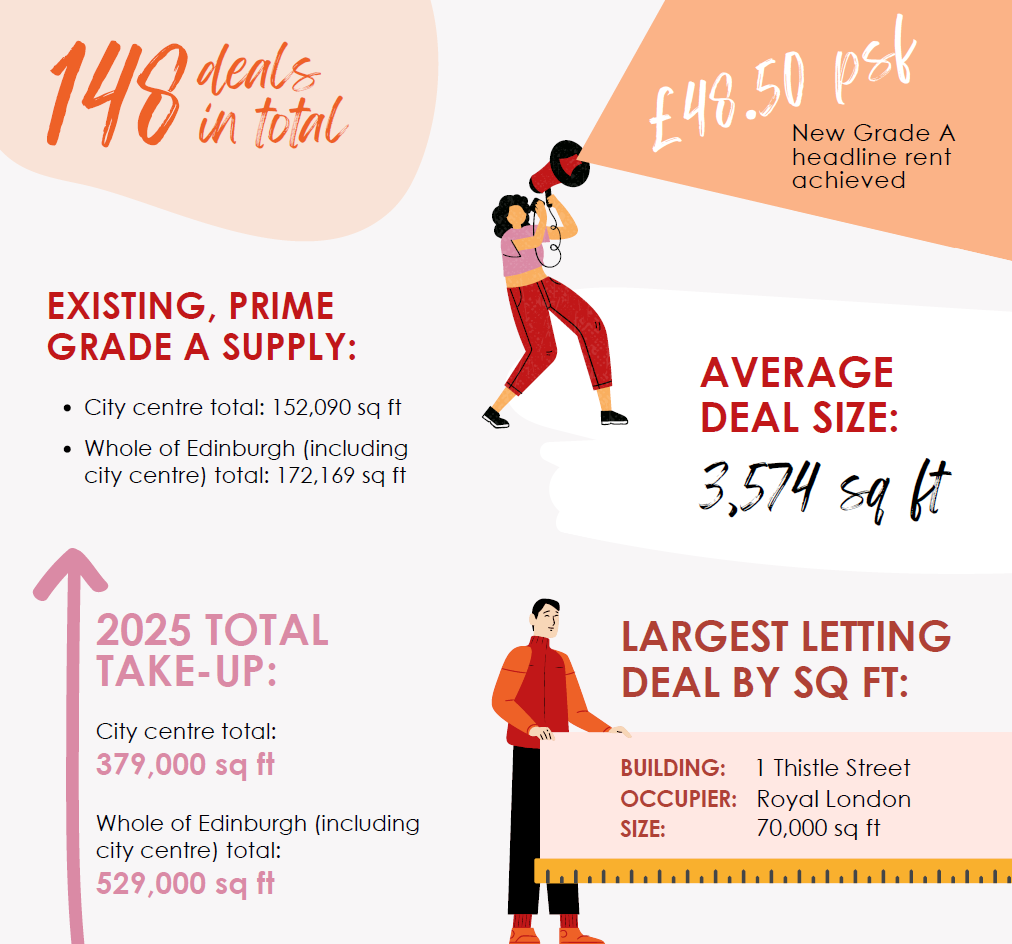

The 2025 Edinburgh office market saw 1,047,000 sq ft of transactions, with lease re-gears accounting for 26% of that total, with a further 24% attributable to sales for alternative use. 72% of the conventional take-up totalling 529,000 sq ft was focused on the city-centre market, with 150k of deals done in West Edinburgh - a significant rise on recent years.

Lease re-gears then are more common due to several factors:

- Geopolitical uncertainty - in an unpredictable world business craves stability;

- Supply constraints - very few good quality alternative options;

- Fit-out costs

With Landlords increasingly aware of the need to constantly refresh and update their buildings, we expect the re-gear trend to continue over the short to medium term - particularly if a building can offer a company future expansion opportunity.

To this end, early conversations and cost-effective, market-facing improvements to existing buildings will prove attractive whilst occupiers need to review all market opportunities well in advance of any lease

event to give themselves maximum leverage in a rapidly evolving market.

Market Insights

"The statistics for office take-up across the ‘Big Six’ (Edinburgh, Glasgow, Manchester, Leeds, Birmingham and Bristol) reveals little in the way of a consistent theme in take-up other than more than half of the country’s regional deals are for Grade A, or more ‘Prime’ - Grade A basically but with significant investment into amenity and entertainment space.

20 years ago, I remember debating with my co-agents why the UK office market didn’t adopt ‘Core and Floor’ principles for the internal leased spaces, but we deemed it a step too far for the market at the time. However, ’Core and Floor’ is finally becoming the route to market for the newest kit. There is a middle ground here for both parties to save money both on delivery, and on dilapidations at expiry. It does make for a poorer viewing experience on a dark winter’s day, but not throwing away perfectly good ceilings during the fit-out stage is at least a positive tick in the ESG box."

Chris Cuthbert | | 07989 395 165

“With several larger corporates now actively seeking space in the Edinburgh-wide market over the next 2 to 5 years, there is increasing talk of “first mover advantage” – i.e the competitive edge gained by the initial mover in a market and how they capture and control limited resources for maximum benefit. This benefit can include raised brand awareness and economies of scale – e.g the best space at a lower price - but it can also set industry standards in terms of fit-out and turbo-charge companies as they retain and secure the very best talent. Given the acute shortage of prime Edinburgh city-centre supply, this can also trigger a “domino/ FOMO effect,” as increasingly anxious occupiers seek not to miss out.

As ever, cost is key as is certainty on delivery – existing buildings which require refurbishment are better placed than cleared sites with consent as there is simply less construction risk. That said, fortune really will favour the brave and we anticipate the re-emergence of a pre-let market in 2026.”

Nick White | | 07786 171 266

“Predicting the exit is often cited as a reason not to invest in office re-position plays, with many agreeing that the occupier markets are not the problem when carrying out appraisals. Savills recently reported regional office investment volumes of £3.6bn in 2025, a 23% increase on 2024 but still 28% and 48% below the five and ten year averages. Like us, they also suggest prime regional yields have moved from 7% to 6.75% in the last 12 months.

With increasing capital inflows to the sector, robust occupier markets and more certainty on costs, we predict that 2026 will see more investors/ developers gaining confidence in their exit assumptions and taking the plunge. RPG’s recent purchase of Exchange Plaza, 50 Lothian Road, Edinburgh is evidence of this. This experienced developer will be rewarded for their deal making as more confidence builds in the sector.”

Stephen Kay | | 07971 809 226

“The softening of the occupational demand in 2025 should be viewed as cyclical rather than structural. We anticipate a market wide improvement in take-up during 2026. What was behind last year’s poor occupational take-up? Contributing factors included ongoing geopolitical uncertainty, increased business operating costs driven by government policy changes, and high-cost office fit-outs.

Furthermore, in 2020, many businesses deferred lease events by agreeing short-term extensions in response to the uncertainty created by COVID-19, allowing time to reassess their operational and occupational requirements. In the years that followed, occupiers still grappled with their long-term office strategies, resulting in elevated levels of lease re-gears across 2021 and 2022. As a result, a higher volume of lease events are now approaching, which is expected to translate into increased market activity and renewed occupational demand.”

James Metcalfe | | 07786 623 282