Edinburgh Office Market Snapshot Q3 2024

Q3 Market Overview

After a very slow July/ August holiday period, the market 161,385 sq ft sparked back into life in Q3 with viewing numbers right back up to Q1 levels with a strong mix of new and existing requirements – a very strong Q4 anticipated.

As ever, nothing is perfect and construction remains challenging with a number of large and smaller contractors falling into administration creating further pressure on already stretched supply chains.

Whilst reasonably priced debt also remains difficult, the sentiment against offices is changing – just ask Jeff Bezos – with city-centre offices still the order of the day and rents now sitting at £45.50 per sq.ft following insurance giant AJ Gallagher’s recent letting at Waverley Gate; refurbished product behind a listed façade with exceptional outdoor (and indoor) amenity.

We also sense a growing recognition from City of Edinburgh Council’s planners that city-centre offices do need protection and are urgently needed to “meet identified gaps in provision.” Put simply, the “hotelification” of our city-centre is impacting negatively on the wider city region in terms of economic generation.

To summarise, we’ve noticed a tangible gear change over the last two months and look forward to a period of renewed activity across the agency and investment arenas.

Market Insights

"Q3 showed an improvement on Q2, which was surprising given what a long and slow Summer it was. The YTD figure is 455,000 sq ft across the city for pure take up, and 340,000 sq ft of re-gears/renewals.

The appetite to ‘make do’ and extend is certainly on the up, but in most cases it is because stock is thin on the ground and relocation has been paused.

I thought it would be worthwhile looking back to 2019 and comparing it against 2024 – 536,000 take up at this stage, with 224,000 sq ft of re-gears. The total square footage is actually ahead this year by 35,000 sq ft, which is a great positive to consider.

We are expecting a very busy final couple of months to round the year off well. More stock is needed urgently!"

Chris Cuthbert | | 07989 395 165

“Having presented this September to The Edinburgh Development Forum on “The Challenges and Opportunities for Delivering Office Space to the City”, it was valuable to discuss the “holy trinity” of exit yield, rent and construction cost with senior planners and Councillors with particular regard to our city-centre office market.

While the local authority rightly focuses on the shortage of affordable housing, there's a growing recognition of the economic multiplier effect generated by office occupation and investment. With two office buildings on St Andrew Square, one on Morrison Street and one on Festival Square all now potentially converting to hotel use on a permanent basis, this will reduce city-centre supply by 200,000 sq ft – akin to 3,000 well-paid jobs – leaving larger occupiers to consider other UK-wide locations for corporate expansion.

Amid construction challenges, we urge city planners to limit alternative uses within a defined city-centre area and help balance the need for prime office space – briefcase and suitcase.”

Nick White | | 07786 171 266

“Whilst the government have delivered an anti-growth budget, raiding UK family businesses and employers, interest rates have dropped, more money has been allocated to Scotland and the Scottish Government have at least indicated they are prepared to consider removing rent controls for purpose built BTR of scale… There are reasons to be cheerful!

2024 so far has seen £270m of office investments made throughout Scotland which does demonstrate investors willingness to enter the sector. This stat does not include those buildings acquired for change of use. Within this, Pontegadea’s purchase of The Mint Building, Edinburgh goes a long way to establishing prime office yields at 7% based upon our view of the outcome of this month’s rent reviews and further supported by the reported transaction of the EQ Building in Bristol for north of £100m and 7.5%.

This all helps developers understand end values which most have been struggling with for the last 12 months. Our view is this will strengthen as more capital begins to understand the real rental growth forecasts in key regional cities.”

Stephen Kay | | 07971 809 226

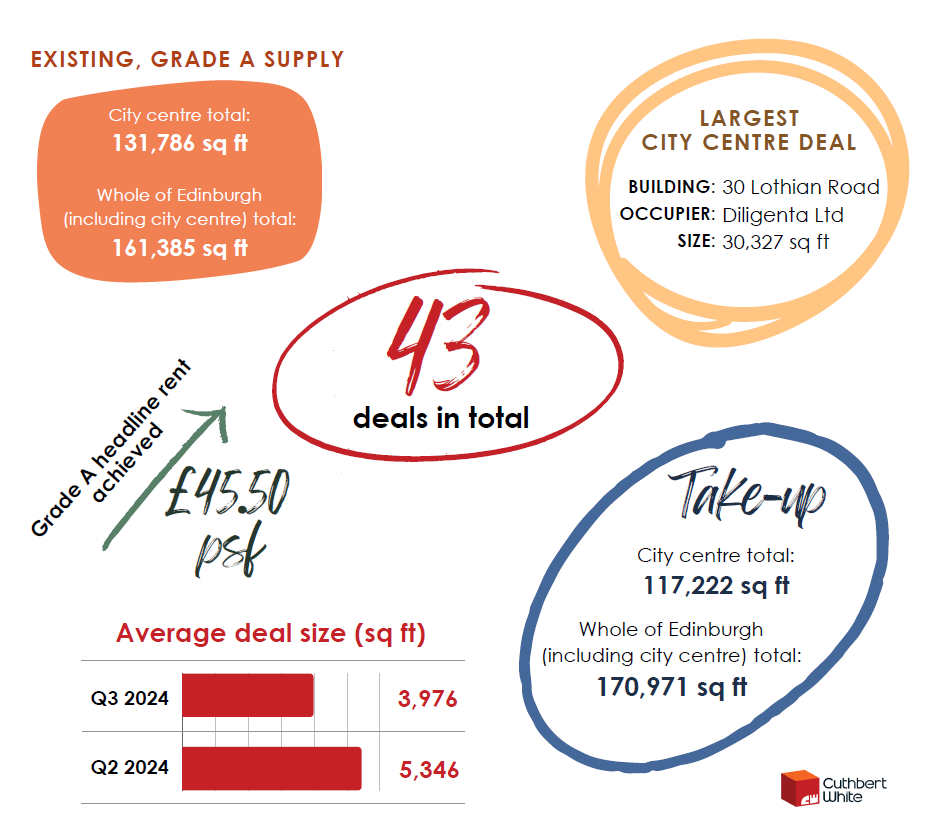

“There has been a 18% increase in the headline rent in the last two years in the Edinburgh office market following a new headline rent being set this quarter at £45.50 per sq. ft, whilst Q3 2022 was £38.50 per sq. ft. It is interesting to highlight Grade A supply levels at the time these headline rents were set: the Grade A availability in Q3 2022 was 245,000 sq. ft, and at present the Grade A availability sits at 131,786 sq. ft – a 46% reduction in Grade A city centre stock.

It is clear the chronic supply levels is in part causing the upward trajectory on Grade A rents. We are hopeful that the supply and demand imbalance, backed by the diverse and strong occupier pool that Edinburgh benefits from, will drive investment into the Edinburgh office market and unlock development opportunities within the city.

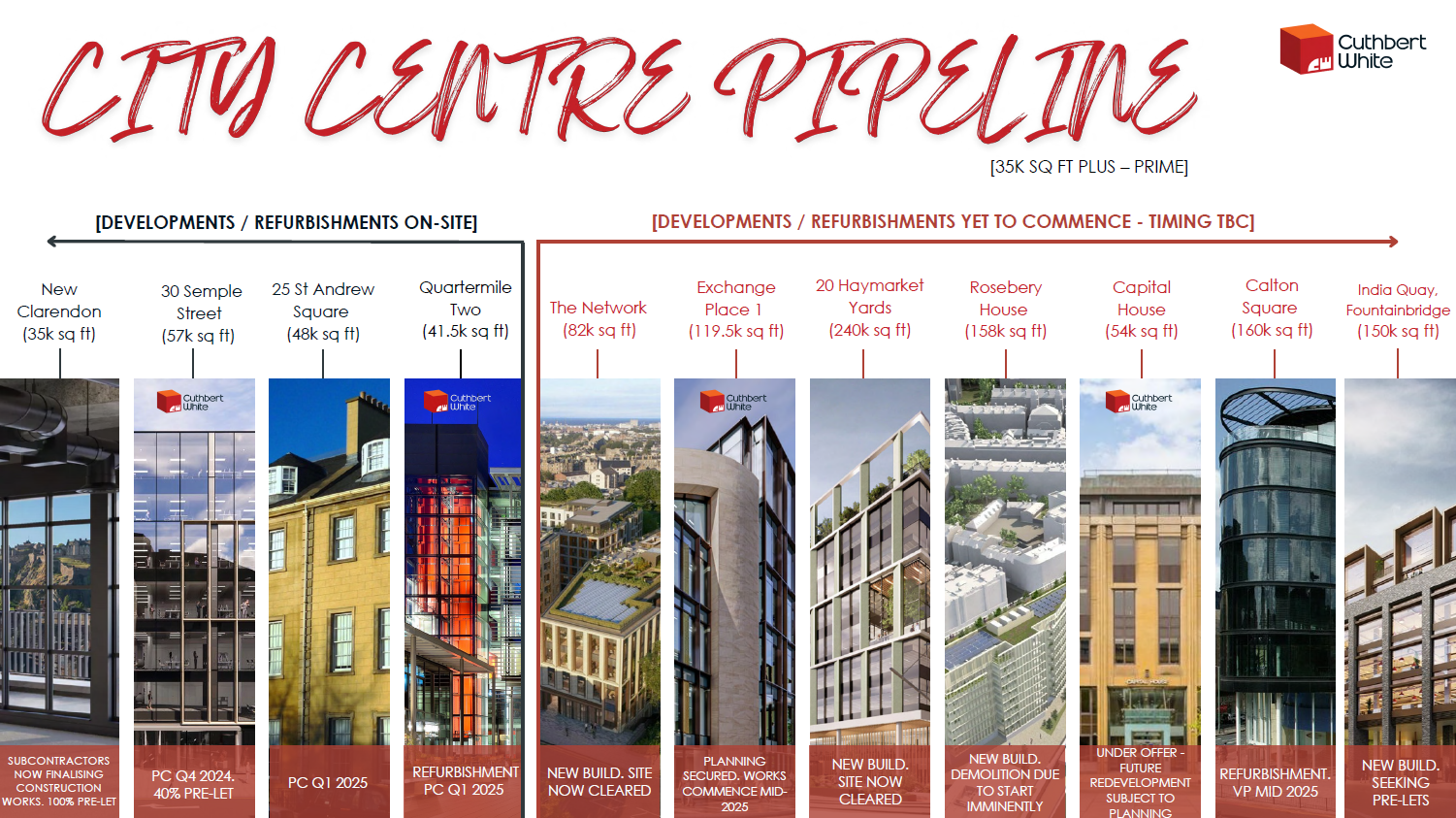

Finally, we do not envisage supply levels improving in the short term with 181,500 sq. ft currently in the pipeline, with 35% of that figure already pre let.”

James Metcalfe | | 07786 623 282