Edinburgh Office Market Snapshot Q3 2023

Q3 Market Overview

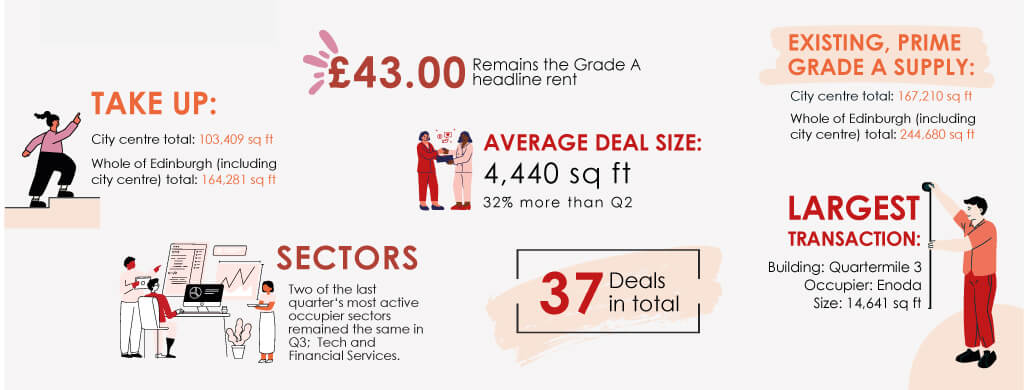

As predicted, Q3 saw a West Edinburgh bounce-back with new or well refurbished product attracting strong tenant demand from a variety of sectors. The city-centre remains very active, particularly at the smaller end of the market although we anticipate a number of larger 20k requirements going under offer this side of Christmas which should lead to final take-up figures around 650,000 sq.ft – a solid if unspectacular year.

Investment activity remains muted as vendors wrestle with revised price expectations and limited demand so deals that can be done at sensible levels with well known, reliable parties are to be welcomed. Interest rate stability remains imperative as markets settle and occupier confidence continues to improve although construction cost volatility remains an issue – hence more “taken as seen” lettings, with schedules of condition and an ability to cannibalise existing fit-out.

Merger and acquisition remains a strong corporate theme and we expect further consolidation over the next year in the fund management and professional services space.

Market Insights

"The development supply pipeline noted below has never been so opaque as it is just now and, like many of the themes in this document, there’s a myriad of governing factors that are ‘challenging’ development appraisals to the limit - we get it. However, we are keen to see if there will be some intervention moving forward to do more to protect office use in the city centre core. Not every tenant can afford the new £40 psf + supply chain, so refurbishments of older stock has never been more critical.

Edinburgh works so well because of its mixed-use environment and it needs to be more considered and not all about hotels; something that Glasgow is finally waking up to by promoting better mixed-use in the city centre such as residential. More ’balance’ in Edinburgh is essential.”

Chris Cuthbert | | 07989 395 165

“Analysing supply is the easy bit – it’s far harder trying to predict demand and what the drivers of future growth might look like. According to Dell Technologies, 85% of jobs in 2030 don’t even exist yet and whilst that might be confusing for some, it’s important to note the incredible potential positive impact the new Edinburgh Futures Institute (EFI) at Quartermile will have upon new jobs and the occupational market over the coming years. This extensive 20,000 sqm refurbishment is now nearing practical completion and looks fantastic – a real game changer.

When you consider the University of Edinburgh’s unique ecosystem (50 different centres, institutes, foundries, schools and hubs) this revitalised building will further turbo-charge Quartermile and provide students and business leaders with a unique, worldleading multidisciplinary space for collaboration, education, research and partnership. Tech unicorns, Skyscanner and Fanduel might have some new rivals before long.”

Nick White | | 07786 171 266

"As with the rest of the UK, office investment transactions are significantly down in Edinburgh despite the city benefitting from one of the strongest occupational markets and some of the greatest pressures from alternative uses in any UK city.

Low transactional volumes tend to happen at times when values are falling which creates uncertainty, however with prudent stock selection and robust asset management plans, office purchases will deliver compelling returns. Not many are currently prepared to sell at levels that reflect the capital investment required to make quality lettable product. They will however have to be prepared to invest in their assets if they are not prepared to sell.”

Stephen Kay | | 07971 809 226

“Over the last 6 months, 51% of all Edinburgh requirements have stipulated a “strong preference for fully fitted suites or will consider inheriting fully or partially fitted space.” Furthermore, according to RICS, it is estimated that 11% of UK construction spending is on fit-outs and that buildings may have 30 to 40 fitouts during their lifecycle. These statistics encapsulate two current themes in the occupational market – 1) occupiers’ awareness of their environmental impact and 2) inflationary pressures on fit-outs. Over the short to medium term as inflation settles and the economy improves, there’s an expectation fit-out costs will begin to plateau. However, the environmental impact of fit-outs will continue to be at the forefront of both landlords and occupiers’ real estate strategies.”

James Metcalfe | | 07786 623 282