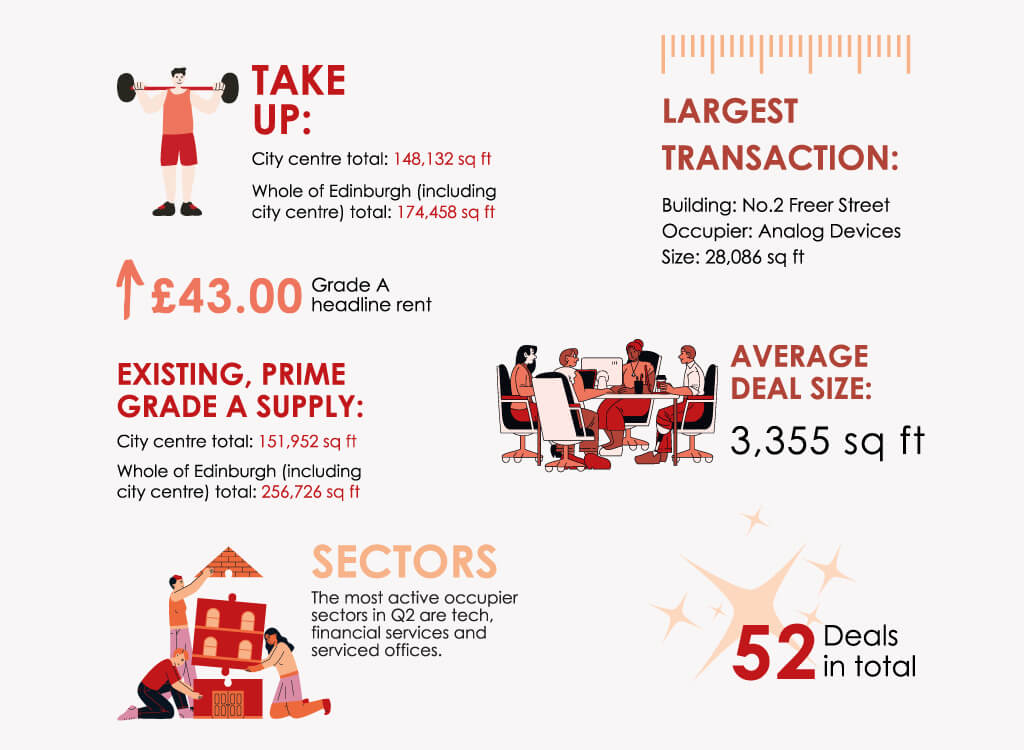

Edinburgh Office Market Snapshot Q2 2023

Q2 Market Overview

The lack of speculative Edinburgh product is well documented and whilst strong rental growth is rife across the core city centre market, it is undermined by continued challenges in the debt and construction markets, together with a lack of investor sentiment.

Whilst take-up is below the 10 year average and the public sector continue to dodge their offices – undermining the cities they purport to serve – office occupancy levels are on the rise and those that do invest be they an investor/developer or occupier, will reap the reward.

Market Insights

"Occupiers are desperate for quality space but will not move if it’s not a step up. Landlord’s cannot be complacent – they need to invest in their spaces and provide a much more 'hands on' asset management service."

Chris Cuthbert | | 07989 395 165

"Whilst total take-up is down, how much of this is attributed to weakened demand or limited supply is a moot point. What is very clear however is that an acute shortage of prime supply – either new or refurbished – is driving the sharpest rise in rental growth ever seen across the city centre with further rental growth expected.

Nick White | | 07786 171 266

"Increased and unpredictable debt and refurbishment costs are causing investors to shy away from considering comprehensive “grey to green” office refurbishments. In Edinburgh city centre, where we have continued demand/supply imbalances, those that do will be rewarded with strong returns."

Stephen Kay | | 07971 809 226

"Devolved powers over nondomestic rates relief for vacant premises means there is a real threat Edinburgh will mimic Aberdeen's abolition of zero business rates for listed properties from April next year. Smart owners of vacant listed buildings will invest into their assets now to maximise lettability and minimise additional costs.

James Metcalfe | | 07786 623 282