Edinburgh Office Market Snapshot Q1 2024

Q1 Market Overview

When you consider the headwinds Scottish property has had to contend with over the last decade (indyref 2 anyone!?), you'd be forgiven for thinking there are many far easier ways to make a living.

One of many adages is that “property's not difficult, it's the people involved that make it difficult.”

Whilst more than a kernel of truth, it never fails to surprise how many seemingly clever people come unstuck with poor, badly informed real estate decisions which impact negatively upon finances, resource and time - the handpicked network of interdependent advisors our trusted clients maintain all there for a reason.

The agents' temptation is to deviate too far from realism into wild optimism - balance, honesty, experience and "on the ground" market intelligence really are everything.

Whilst we are confident of steadily improving market conditions, the fundamentals remain imperative - stock selection, timing, competing developments/pipeline supply, ESG credentials, occupier requirements - the wheat from the chaff.

We hope you enjoy this update and look forward to welcoming you to our new HQ at 36 North Castle Street soon.

Market Insights

"Q1 2024 was just slightly behind the same period in 2023, and the total take up in 2023 across the city was very close to the 5 year average of 650,000 sq ft. There are numerous transactions above 10,000 sq ft currently under offer in the city and we expect to see figures improve during the next 2 quarters along with more rental growth.

210,000 sq ft in Q1 2024 is certainly a strong start to the year, but one transaction on Edinburgh Park has skewed those figures, as it’s a concessionary leasing deal to one of our charity clients, Edinburgh Palette. However, that does result in less vacancy in West Edinburgh which is no bad thing, and it’s really good to see transactions concluding on the best stock out there too."

Chris Cuthbert | | 07989 395 165

“Whilst all agents by default work in the optimism business, some balance is required as distress and defaults continue this year, although the reality is somewhere in between, as:

1. Our clients know interest rates will come down – they don’t know when but they know they will;

2. Labour will win a landslide general election this year giving markets certainty;

3. Employment figures continue to rise giving a positive job growth forecast – more people working = more embedded occupational demand;

4. More companies are ordering/ enticing staff to come into the office more often – hybrid is here to stay with 3 or 4 days a week the new normal;

5. The growth of jobs and the supply of space are moving in opposite directions – hence rental growth;

6. We expect competition amongst tenants for the highest quality space to intensify – this in practice means a pre-let market.”

Nick White | | 07786 171 266

“The 2024 property press has reported more “new money” considering re-position plays as increasing numbers now see the office sector as the one presenting the most opportunity. I agree but identifying good quality options particularly in Edinburgh, remains tricky given the competing pressure from other uses.

Aberdeen has witnessed office transactions at figures reflecting net initial yields of 10-17% and Glasgow is also seeing transactions close with 1 West Regent Street rumoured to be under offer at a figure reflecting a net initial yield of 8.75%. We hope this will lead to more confidence in transacting offices”

Stephen Kay | | 07971 809 226

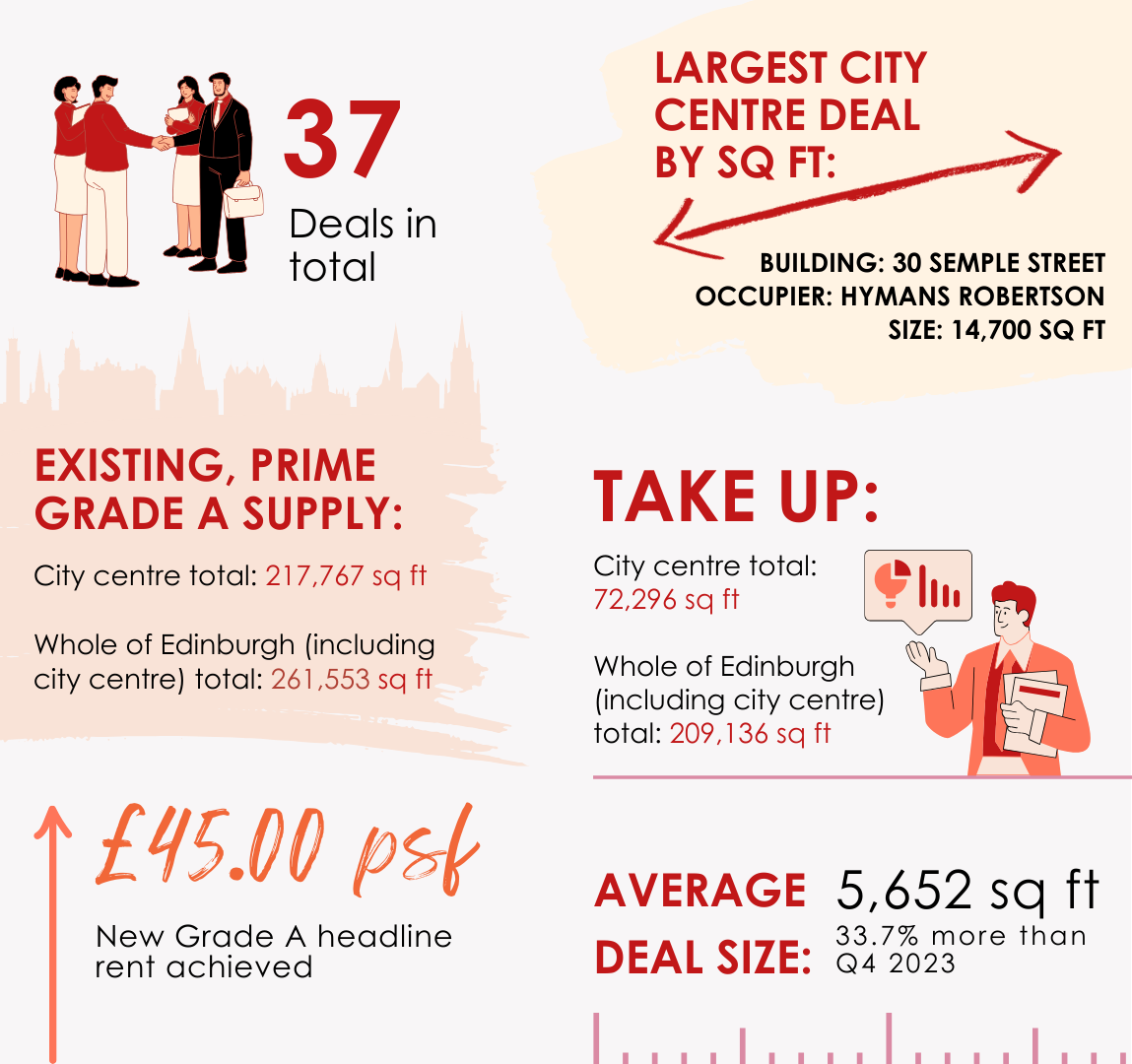

“Whilst Q1 2024 overall city centre take up concluded at 72,296 sq ft in comparison to 90,872 sq ft in Q1 2023 reflecting a 22% reduction, the reduction in take up does not reflect actual occupier demand within the market currently. In comparison to Q1 2023, there was a 37% increase in live requirements in Q1 2024, highlighting true demand in the current market which will hopefully translate into increased take up in Q2 and Q3 this year. Additionally, from Q1 2023 to Q1 2024, the average agreed rent over 3,000 sq ft in the city centre grew from £30.92 per sq ft to £34.16 per sq ft, a 9.96% increase and a statistical display of the rental growth taking effect in the city centre market. As supply becomes increasingly constrained in the city centre, we have noted a 68% increase from the previous year in live requirements looking for space in West Edinburgh, Leith, and peripheral City Centre where Grade A supply levels currently stand at 261,553 sq ft in comparison to 217,767 sq ft in the city centre.”

James Metcalfe | | 07786 623 282