"The 2025 Edinburgh office market saw 1,047,000 sq ft of transactions, with lease re-gears accounting for 26% of that total, with a further 24% attributable to sales for alternative use...With Landlords increasingly aware of the need to constantly refresh and update their…

We'd like to wish all our clients, partners, colleagues and friends a very merry Christmas and best wishes for 2026!

CuthbertWhite is heading to UKREiiF 2025!

We’re thrilled that CuthbertWhite has been recognised in the 2025 Annual CoStar Awards with No1 positions in three categories.

"After a very slow July/ August holiday period, the market 161,385 sq ft sparked back into life in Q3 with viewing numbers right back up to Q1 levels with a strong mix of new and existing requirements – a very strong Q4 anticipated." ...

"After a blistering Q1, occupational demand slowed after Easter and pre-election, as interest rates remained stuck at 5.25% and the economy – and more importantly occupiers – played a game of 'wait and see'." ...

"Whilst we are confident of steadily improving market conditions, the fundamentals remain imperative - stock selection, timing, competing developments/pipeline supply, ESG credentials, occupier requirements - the wheat from the chaff."

We're delighted to have moved to our new office space at 36 North Castle Street, Edinburgh.

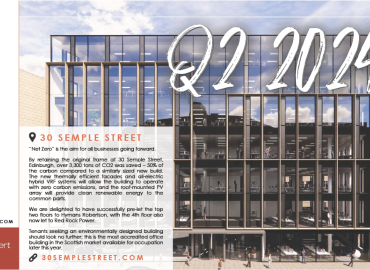

Hymans Robertson will be taking 14,700 sq ft at 30 Semple Street and is the first occupier to sign up to Edinburgh’s newest and greenest office development.

The CoStar Awards recognise and celebrate commercial real estate's top agents and agencies across the UK and we're delighted to have recently won three of the five categories for the Edinburgh office market.

The Q4 Edinburgh office market was characterised by 3 things – a clear return in confidence to the occupational markets, aggressive alternative use buyers taking advantage of continued negative office investment sentiment and further construction cost volatility.

It's that time of year and CuthbertWhite are back with a new offering...Merry Christmas One and All, and best wishes for a prosperous 2024!